KTM’S RESTRUCTURING PLAN – KEY TAKEOUTS

This week, KTM’s creditors approved the company’s proposed restructuring plan. But does that mean the future of the iconic motorcycle brand has been secured? And with implications for thousands of jobs, the stakes are high.

You will have probably heard that, earlier this week, KTM’s creditors voted to approve the company’s restructuring plan at the regional court in Upper Austria. After three months of uncertainty, the plan’s approval not only puts to rest the speculation about the company’s immediate future, but it also appears to have prompted some soul searching from KTM’s management group in Austria.

Like most large-scale corporate restructures, KTM’s plan is complex. It involves lots of moving parts, many stakeholders, and has implications for thousands of jobs. But in layman’s terms, what does this approved restructuring plan actually mean for the Austrian brand? Here are the key points we took from this week’s pivotal developments…

THE RESTRUCTURING PLAN…

- This disruptive chapter for KTM all started back on November 29, 2024, when insolvency proceedings were initiated. KTM AG (a wholly owned subsidiary of Pierer Mobility AG) applied for court restructuring proceedings with self-administration. The aim of the proceedings was to agree on a restructuring plan with the creditors within 90 days.

- February 25 (Tuesday this week) was D-Day for KTM, when the insolvent company’s numerous creditors – collectively owed around €2 billion (AUD $3.3 billion) – voted on the debt restructuring plan proposed by KTM management. It offered creditors 30% of what they’re owed.

- At the meeting, the creditors accepted the restructuring plan submitted by KTM AG. Under this approved plan, creditors will receive one-off payment (cash quote) of 30% of their claims. And in order to fulfil the 30% quota, KTM AG is obliged to deposit €548 million (AUD $911 million) with the restructuring administrator by May 23, 2025.

- At the beginning of June, 2025, the court will then finalise the restructuring process, and the restructuring proceedings of KTM AG will end once it becomes legally binding. In other words, it will bring KTM out of insolvency.

- In order to finance the 30% cash quota and further production, the Group requires fresh capital of around €800 million (AUD $1.33 billion). According to KTM, “Citigroup Global Markets Europe AG was commissioned to support this investment process in a structured, transparent and efficient manner in the interests of all stakeholders”.

RESUMING FULL PRODUCTION…

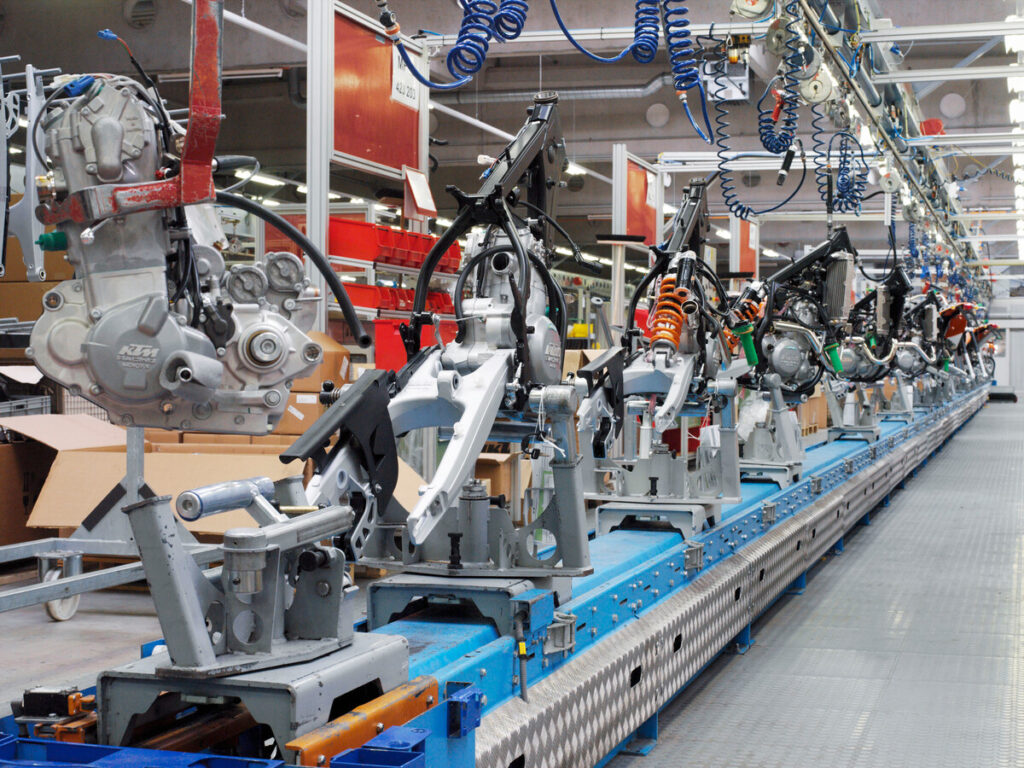

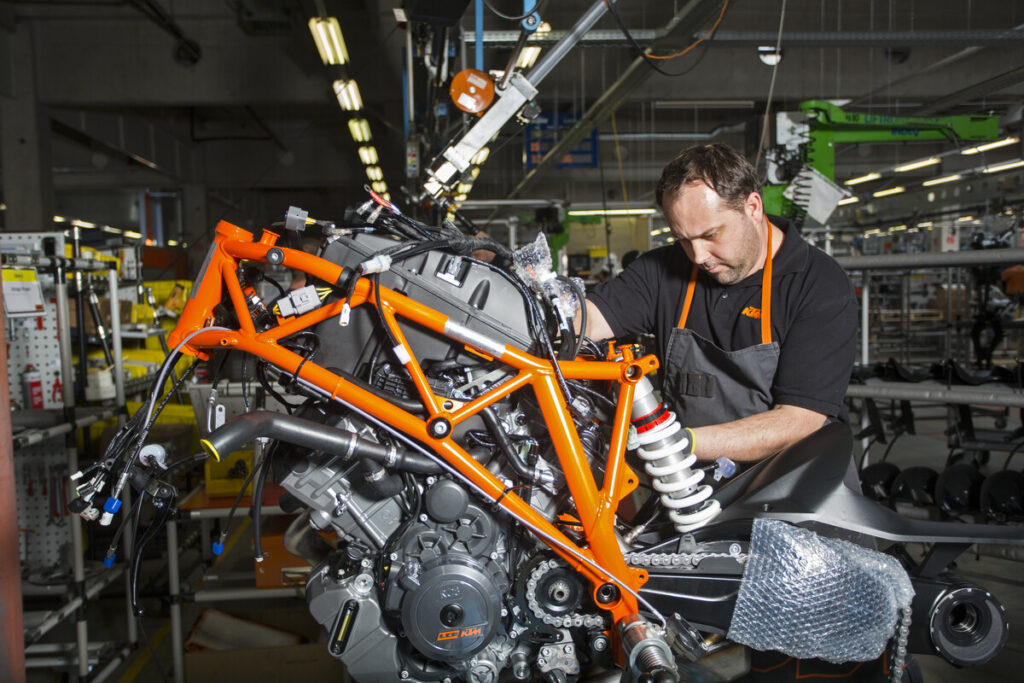

- To enable KTM’s production to be ramped up again gradually from mid-March, 2025, KTM AG will be provided with financial resources totaling €50 million (AUD $83 million) from the extended circle of shareholders. With the approval of the reorganisation plan, this amount will be transferred to KTM AG to cover the costs of the phased resumption of production. It’s expected that the four production lines (in single-shift operation) will be back to full capacity within three months.

- As of February 2025, KTM’s restructuring received a critical boost with fresh capital injections from several investors – including India’s Bajaj Auto and China’s CFMOTO – that are said to have amounted to around €900 million (AUD $1.5 billion), with €150 million (AUD $250 million) allocated for the proposed production restart on March 17, 2025.

KEY PERSONNEL & RACE TEAMS…

- Stefan Pierer (who originally acquired KTM in 1992 when the brand was struggling) took proactive steps to regain creditor confidence, including stepping down from his longstanding role as CEO of KTM AG and Pierer Mobility AG in January, 2025.

- Pierer’s replacement, Gottfried Neumeister, brings extensive business experience – including time at Siemens, airline Flyniki, and catering giant DO & CO. His appointment, along with financial backing from key investors, reassured creditors that the company was on a sustainable path.

- KTM’s motorsport activities are expected to continue, though 2025 has seen a reduced factory rider line-up (from 52 to 40 riders). The KTM Factory Racing team in Munderfing (a township that’s 5km south of KTM’s HQ in Mattighofen) employs 150 staff and remains operational. So KTM Factory Racing, at least in the short term, appears to be secure.

RUMOURS PUT TO REST…

- Recent rumours that BMW had made a bid to take over KTM (and shift its Austrian operations to German) have been dismissed as false, with KTM executives making it clear that no such deal was even considered. After all, BMW is dealing with its own financial problems amid fears of a recession gripping the German economy. Plus it’s hard to think that the Austrian government would endorse the moving of KTM’s premises (and the thousands of losses that would entail) to Germany!

- KTM’s restructuring plan approval was granted despite opposition from US hedge fund, Whitebox Advisors, who bought up a large portion of KTM’s debt – presumably in the hope they could pressure KTM into repaying more than 30% of the outstanding amount. Though, given that KTM are obliged to pay the 30% within two months (not the two years as required by Austrian law), Whitebox could argue that their ambitions were partly successful.

Be the first to comment...